Video Verification Anytime,

Anywhere: Go Agent-Free!

Onboard customers with real-time verification with Kriyam.ai's tested and trusted Video KYC (V-CIP) solution.

Supercharge your verification

processes with unassisted VKYC

No more call scheduling with agents.

Let customers complete the video KYC process on their ownfrom their mobile devices, without any dependency

Onboard Customers 24x7

Eliminate Queuing and Waiting

Verify Customers 5x Faster

Real-time & Accurate Verification

Why switch to Unassisted KYC

Speed and Efficiency

Unassisted KYC enables instant customer onboarding, making it the fastest verification method.

Cost-Effective

Unassisted KYC is a fraction of the cost of traditional methods.

Accuracy

Advanced algorithms ensure higher accuracy by reducing manual errors.

Customer Convenience

Provides a seamless KYC experience anytime, anywhere.

Enhanced Security

Biometric and AI-driven methods enhance security and reduce fraud risk.

Scalability

Completely digital workflow, easy to scale up or down, on demand

Speed and Efficiency

Unassisted KYC enables instant customer onboarding, making it the fastest verification method.

Cost-Effective

Unassisted KYC is a fraction of the cost of traditional methods.

Accuracy

Advanced algorithms ensure higher accuracy by reducing manual errors.

Customer Convenience

Provides a seamless KYC experience anytime, anywhere.

Enhanced Security

Biometric and AI-driven methods enhance security and reduce fraud risk.

Scalability

Completely digital workflow, easy to scale up or down, on demand

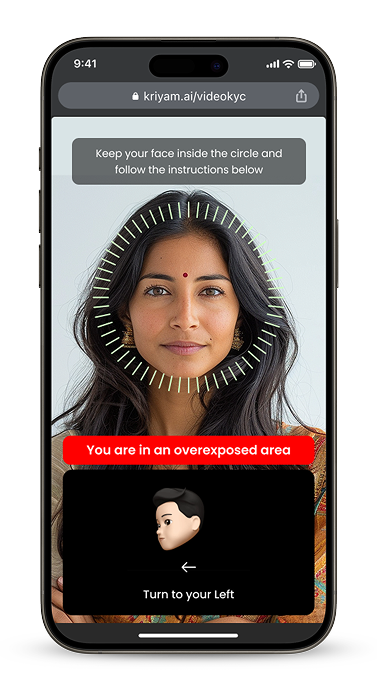

Real-time Verification with AI powered features

Experience fast, secure, and intelligent identity verification with advanced

facial scanning, document parsing and fraud detection features

Biometric Verification

Works even with masks, glasses, and hats

Get real-time vitals from a short video

Accurate demographic identification

Instant face match + liveness + fraud checks

Fraud Detection

Spoof detection

Deduplication

Liveness detection

Forgery checks

Quality Check

Lighting quality

Blur or Shake

Document Type detection

Data Validation

Intelligent Document Processing

Smart Classification: PAN, Aadhar, Passport, Driving License, other OVDs

Extract Contextual Data from

Tampering & Forgery Detection

Cross verification with other sources

Biometric Verification

Works even with masks, glasses, and hats

Get real-time vitals from a short video

Accurate demographic identification

Instant face match + liveness + fraud checks

Fraud Detection

Spoof detection

Deduplication

Liveness detection

Forgery checks

Quality Check

Lighting quality

Blur or Shake

Document Type detection

Data Validation

Intelligent Document Processing

Smart Classification: PAN, Aadhar, Passport, Driving License, other OVDs

Extract Contextual Data from

Tampering & Forgery Detection

Cross verification with other sources

Supercharge your verification

process across multiple use cases

Want to know more about how it works?

Talk to UsNew Customer

Onboarding (KYC)

Continuous

Monitoring (Re KYC)

Identity Fraud

Prevention

Insurance Claims

Processing

Why choose Kriyam Video KYC?

Kriyam.ai is dedicated to delivering a platform that prioritizes efficiency, accuracy, and the highest

standards of safety and security for our clients. Here’s why Kriyam Video KYC stands out

Universal Accessibility

With guided voice assistance and a context-aware system, our KYC process is intuitive and efficient. Users receive step-by-step guidance, with the platform seamlessly adapting to individual needs.

Reliable in Low Network Conditions

Our platform performs consistently well even in low connectivity environments, ensuring accurate results and uninterrupted service anywhere, anytime.

Compliance with Industry Standards

We meet rigorous compliance requirements, adhering to regulations from RBI, SEBI, IRDAI, and PFDRA. We continuously update our platform to align with the latest industry standards.

Robust Data Encryption

Our platform performs consistently well even in low connectivity environments, ensuring accurate results and uninterrupted service anywhere, anytime.

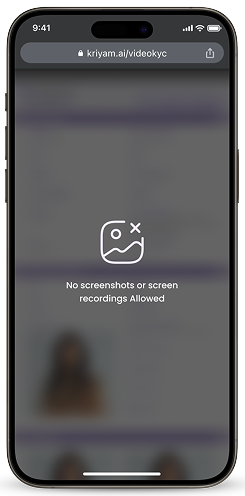

Commitment to Data Privacy & Security

We operate with a strict no-data-collection policy, ensuring your data remains private. Our robust security measures guard against unauthorized access, putting your privacy first.

Universal Accessibility

With guided voice assistance and a context-aware system, our KYC process is intuitive and efficient. Users receive step-by-step guidance, with the platform seamlessly adapting to individual needs.

Reliable in Low Network Conditions

Our platform performs consistently well even in low connectivity environments, ensuring accurate results and uninterrupted service anywhere, anytime.

Compliance with Industry Standards

We meet rigorous compliance requirements, adhering to regulations from RBI, SEBI, IRDAI, and PFDRA. We continuously update our platform to align with the latest industry standards.

Robust Data Encryption

Our platform performs consistently well even in low connectivity environments, ensuring accurate results and uninterrupted service anywhere, anytime.

Commitment to Data Privacy & Security

We operate with a strict no-data-collection policy, ensuring your data remains private. Our robust security measures guard against unauthorized access, putting your privacy first.

Experience the future of Video KYC (V-CIP)

With

FAQs

Common Questions About

Video KYC

Get quick answers about how Video KYC understand, extract, and validate data — not just read it.

What is unassisted AI-based KYC?

How does unassisted AI-based KYC work?

Is unassisted AI-based KYC secure?

What types of documents can be verified using unassisted AI-based KYC?

How accurate is the document verification process?

How does facial recognition work in unassisted AI-based KYC?

What is liveness detection, and why is it important?

How user-friendly is unassisted AI-based KYC?

How long does the unassisted AI-based KYC process take?

Blogs